empower retirement hardship application

GREENWOOD VILLAGE Colo April 2 2020 Empower Retirement is waiving fees on all new retirement plan loans and hardship withdrawals in an effort to support the financial needs of American retirement investors resulting from the COVID-19 outbreak and the related fallout in the economy. The content contained on this website has been prepared for informational and educational purposes only and is not intended to provide investment legal or tax advice.

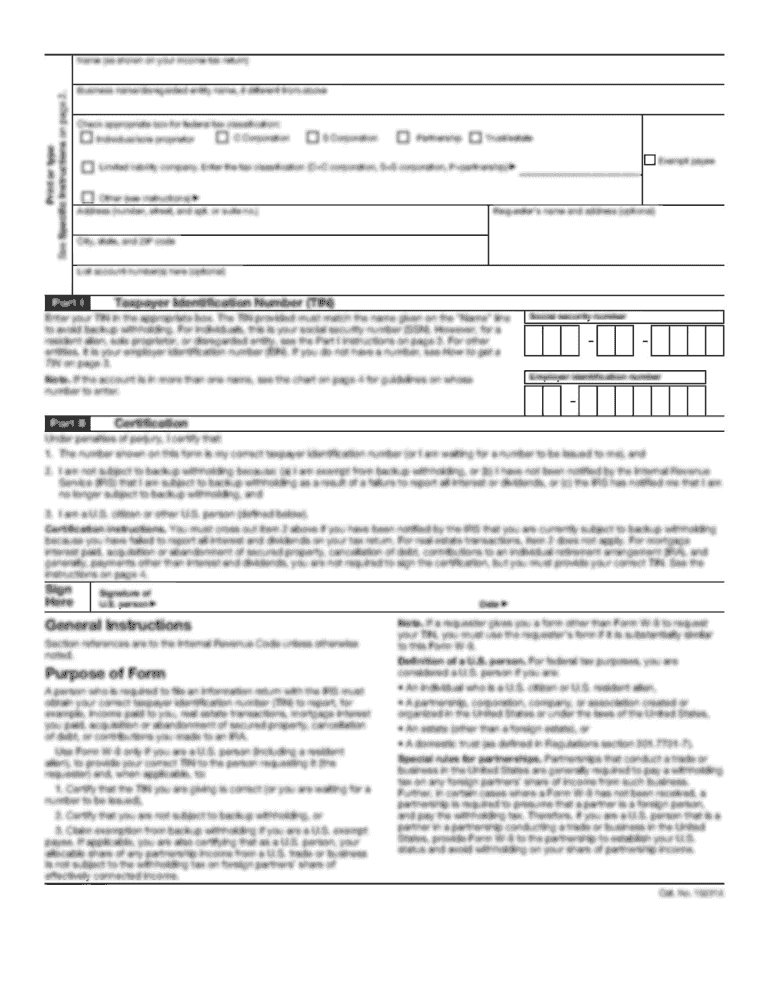

APPLICATION FOR HARDSHIP WITHDRAWAL To be Completed by the Participant.

. A loan from an IRA or IRA-based plan would result in a prohibited transaction. And registered investment adviser Advised Assets Group LLC. The Senior Hardship Support Services Representative is responsible for educating and guiding participants and plan contacts through the entire hardship withdrawal process for both standard and complex requests.

These plans use IRAs to hold participants retirement savings. All individuals regardless of personal characteristics are encouraged to. Empower Retirement Greenwood Village CO.

For active employees who have a qualifying hardship event. Biometric identification and multi-factor authentication provide added security to help protect your identity privacy assets and data. Empower will not charge origination fees on any new plan.

GWFS is an affiliate of Empower Retirement LLC. However a 10 additional tax generally applies if you withdraw IRA or retirement plan assets before you reach age 59½ unless you qualify for another. With the Empower mobile app you can manage all your Empower accountsanytime anywhereincluding your retirement plan investment accounts health savings accounts and more.

You can withdraw money from your IRA at any time. Hardship Distribution Request Form. Biometric identification and multi-factor authentication provide added security to help protect your identity privacy assets and data.

With the Empower mobile app you can manage all your Empower accountsanytime anywhereincluding your retirement plan investment accounts health savings accounts and more. Section A - Plan Information Plan Administrator completes Section B - Participant Information Participant completes Questions. MassMutual Retirement Services MMRS is a division of Massachusetts Mutual Life Insurance Company MassMutual and affiliates.

Participants Name _____ _____ _____ first middle last Social Security No.

Leaders With Influence Give When They Don T Have To Care For Others Grow Continuously Live Authentica Care For Others Inspirational Quotes Teacher Resources

50 Budgeting Quotes To Motivate You And Your Bottom Line

Empower Hardship Withdrawal Form Fill Online Printable Fillable Blank Pdffiller

Empower Hardship Withdrawal Form Fill Online Printable Fillable Blank Pdffiller

Walmart 401 K Plan Hardship Request Withdrawal Guide Hardship Withdrawal Request Pdf4pro

How To Divide Retirement Pensions In Divorce Year

Walmart 401 K Plan Hardship Request Withdrawal Guide Hardship Withdrawal Request Pdf4pro

Kist To Be Elevated To National Polytechnic Status In 2022 Ministry Of Education Secondary School Teacher Youth Empowerment